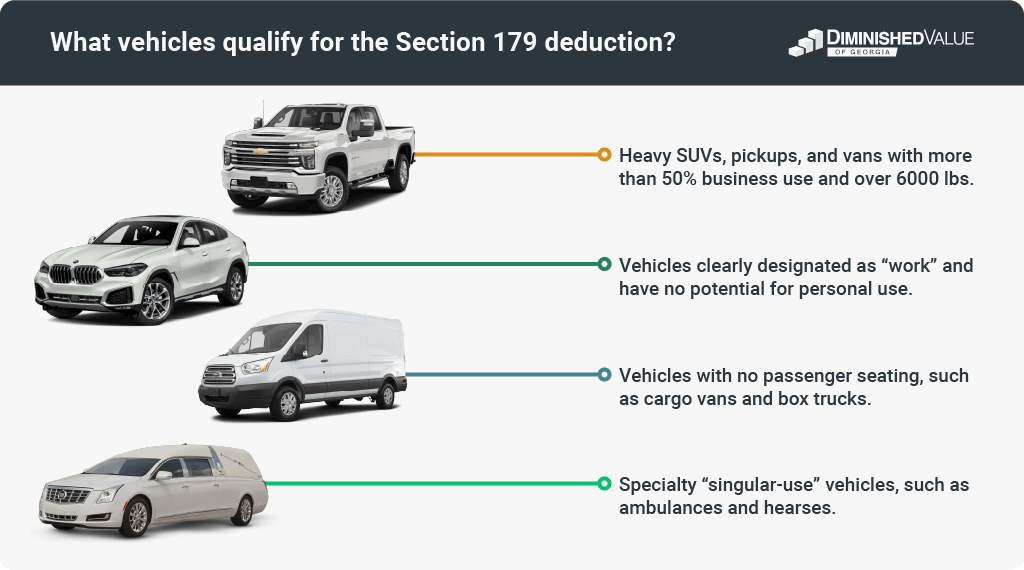

Irs Section 179 Vehicles 2025 – If you purchase assets for your business during the tax vehicle weight rating (GVWR) between 6,001 and 14,000 pounds, and you’re allowed a maximum Section 179 deduction of $30,500 for 2025 . From StreetsBlog: In the last few years, the internet has exploded with memey tributes to Section 179 of the US tax code, which, as of tax year 2023, allows U.S. business owners to deduct the costs of .

Irs Section 179 Vehicles 2025

Source : www.section179.orgList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

Source : diminishedvalueofgeorgia.comPut your best foot forward in 2025: Combine Section 179 with

Source : blog.ritchiebros.comSection 179 Eligible Vehicles at Bob Moore Auto Group

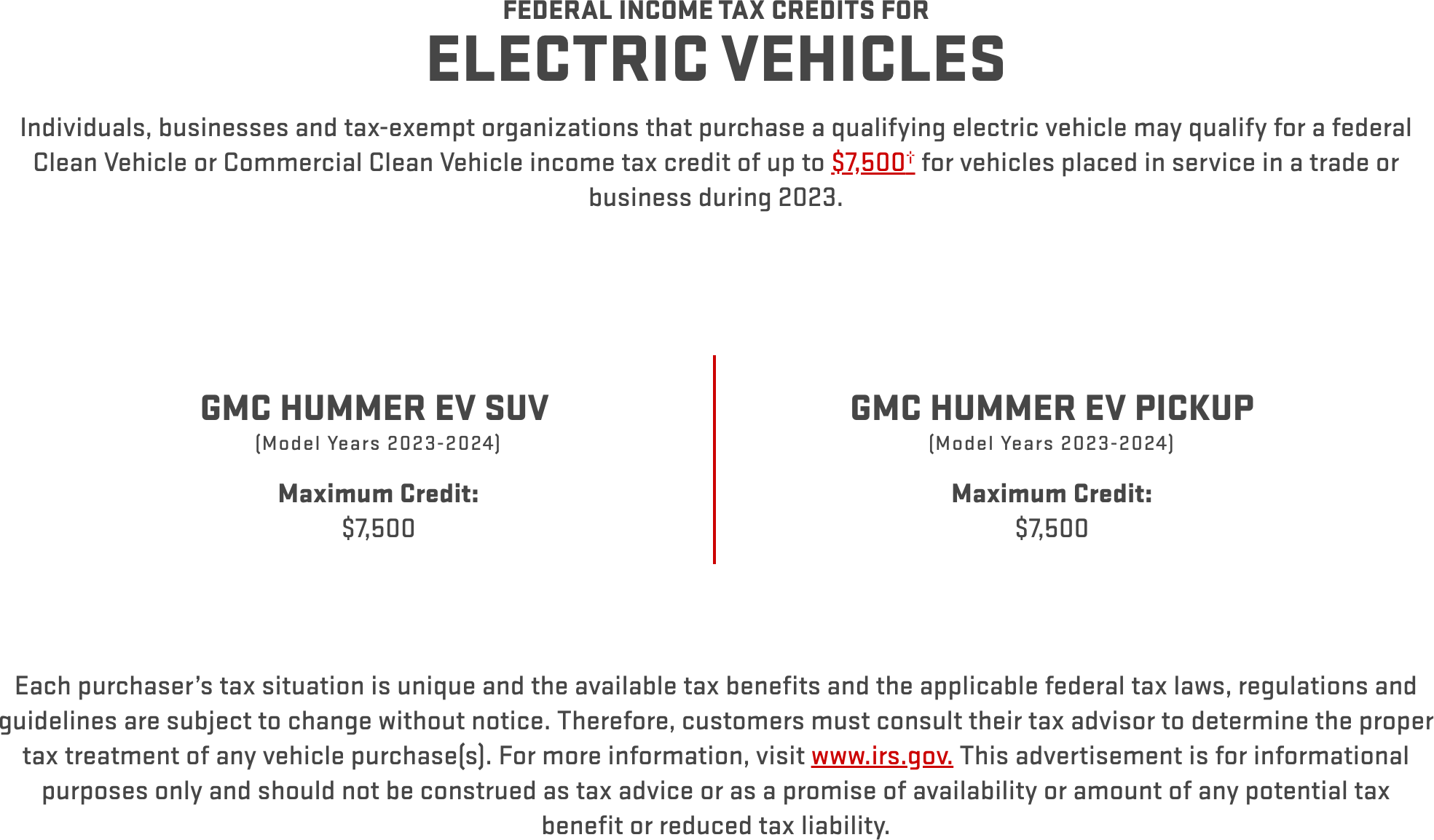

Source : www.bobmoore.comUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comUpdate] Section 179 Deduction Vehicle List 2025 | XOA TAX

Source : www.xoatax.comSection 179 Vehicles For 2025 Balboa Capital

Source : www.balboacapital.comUpdate] Section 179 Deduction Vehicle List 2025 | XOA TAX

Source : www.xoatax.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.comSection 179 IRS Tax Deduction Updated for 2025

Source : www.netsapiens.comIrs Section 179 Vehicles 2025 Section 179 Deduction – Section179.Org: These exceptions are primarily smaller passenger vehicles or cargo vans. The Section 179 deduction is claimed by completing Internal Revenue Service Form 4562 and attaching the form to a business . Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when .